WE HELP

TO GROW YOUR BUSINESS

"Explore Tailored Financial Security Solutions with Mahesh Kulkarni: Your Partner for Comprehensive Policy Design and Management."

About Us

We Help Clients To Get Success

Introducing Mahesh Kulkarni: Your Insurance and Financial Management Expert

Mahesh Kulkarni stands out in the insurance industry with his client-first philosophy, offering tailor-made Health, Accident, and Life Term Insurance solutions. His plans are designed to safeguard against uncertainties, providing peace of mind.

As a personal financial management advisor, Mahesh focuses on achieving your financial goals through customized advice and strategic planning. His expertise helps navigate financial complexities, aiming for long-term prosperity.

Proudly serving 500 satisfied clients, Mahesh's commitment to excellence is evident. He's set to broaden his impact, targeting 1000 clients by 2025, driven by a mission to ensure financial security and a prosperous future for all.

Join Mahesh Kulkarni on a journey to financial empowerment, as

What We Provide

WHY FINANCIAL PLANNING IS IMPORTANT

🏦 Foundation for Financial Stability: Establishes a solid base for financial stability.

🎯 Priority Setting: Helps prioritize financial goals effectively.

🛡️ Risk Management: Balances risk through diversification of investments.

📆 Long-Term Planning: Encourages strategic planning for future needs.

💰 Financial Discipline: Promotes regular saving habits and wise investments.

🔄 Adaptability: Allows for adjustments as circumstances change.

🌟 Wealth Accumulation: Facilitates the growth of wealth over time.

😌 Peace of Mind: Reduces financial stress by having a structured plan.

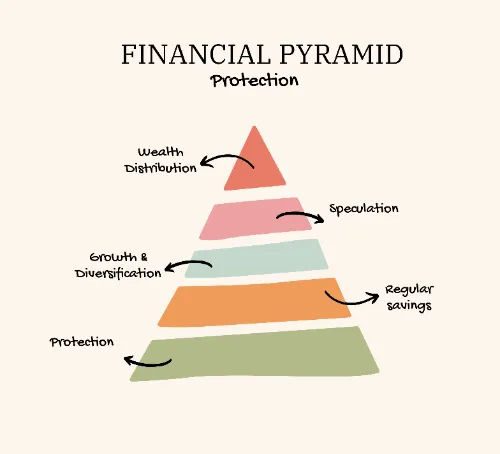

PROTECTION

Health Insurance: Shields against medical expenses and accidents.

Term Insurance: Ensures financial security for loved ones in unforeseen events.

Primary Health Care: Facilitates access to essential medical services.

Accident Insurance: provides a lump-sum benefit for unexpected accident-related expenses."

REGULAR SAVINGS

Retirement Planning: Tailored strategies for a worry-free retirement.

Child Education Investment: Structured plans to fund children's education

Tax Planning: Maximizing savings through strategic tax planning

Life Insurance: Ensuring financial stability for the future.

GROWTH & DIVERSIFICATION

Mutual Funds: Opportunities for wealth growth through investments.

Long-Term Investments: Strategic planning for financial objectives.

Get your Financial Planning With Practical Approach

Register Now With Limited Seats Available.

Our Achievements

500+

Clients

15+

Years

Successful Team of 500+ Clients, That Has Helped Countless Individuals And Families Find The Insurance Solutions and Financial Planning They Needed.

500+

Clients

15+

Years

What client say about us

"Exceptional Financial Planning by Globe Xpand Solutions! Manoj Wadnere here, and I'm thoroughly impressed. Their expertise in creating personalized financial plans exceeded my expectations. The process was smooth and easy, thanks to their outstanding customer service. Highly recommend them for reliable financial planning."

Manoj Wadnere

"Outstanding Financial Planning by Globe Xpand Solutions! I'm Akshay Upalkar, and I was truly impressed by their service. Their team, both knowledgeable and welcoming, ensured a seamless and efficient planning process. Globe Xpand Solutions stands out in crafting personalized financial strategies, making them an excellent choice for anyone's financial planning needs."

Akshay Upalkar

Frequently Asked Question

What is financial planning and why is it important?

Financial planning is the process of setting, prioritizing, and achieving financial goals. It's important because it helps you manage your income, expenses, investments, and savings effectively, ensuring financial stability and security for the future.

How do I start creating a financial plan?

To start financial planning, begin by assessing your current financial situation. This includes understanding your income, expenses, debts, and savings. Set specific, measurable financial goals, create a budget, and plan for savings and investments. Regularly review and adjust your plan as needed.

What should I include in my financial plan?

Your financial plan should include a budget, an emergency fund, insurance coverage, investment strategies, retirement planning, and estate planning. Each of these components plays a crucial role in securing your financial future.

How does health insurance contribute to my financial plan?

Health insurance is a critical component of financial planning. It protects you from the high costs of medical care, ensuring that a health crisis does not derail your financial goals. By covering expenses for treatments, hospital stays, and sometimes even preventive care, health insurance helps you maintain financial stability in the face of health uncertainties.

What is the difference between accident insurance and life term insurance, and why are both important?

Accident insurance provides coverage specifically for injuries resulting from accidents. It typically covers medical expenses, loss of income during recovery, and sometimes death or dismemberment benefits. Life term insurance, on the other hand, provides a death benefit to your beneficiaries if you pass away during the term of the policy. Both are important as they offer financial protection in different scenarios: accident insurance for unforeseen injuries and life term insurance for providing for your family in case of your untimely death.

Quick Links

About Us

Services

Contact Us

Social Media Links

Contact Us

9923055666

Soba tower, A102,103,104, Besides, Hospital, Sadashiv Peth, Pune, Maharashtra 411030